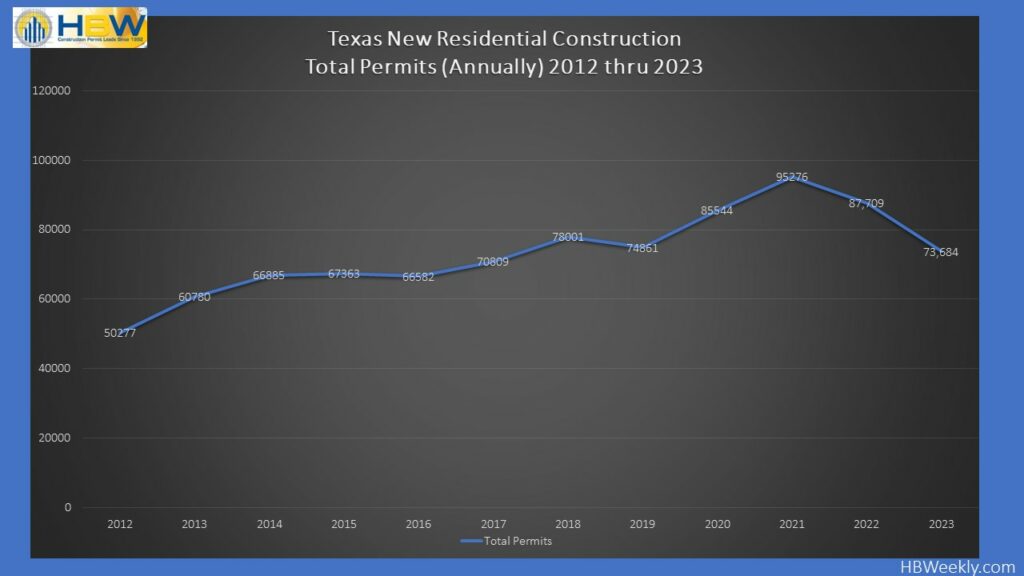

Last month, there were approximately 5,850 new residential construction permits with a total value in excess of $1.75 billion added to the HBW database for the Lone Star State. Out of the four major metro areas reviewed (Houston, Dallas, Austin, San Antonio), Houston carried the greatest volume of new residential construction (2,999 permits), while the highest average value of new home construction could be found in the Dallas area (average value: $354,456).

Here is a closer look at the permit data for new residential construction in Texas by metro area during the month of January:

Houston

As previously noted, there were approximately 3,000 new residential construction permits with a total value in excess of $848 million in the Houston area last month. The average value of new home construction was $282,832, and the majority of new construction activity took place in the two counties of Harris (1,205 permits) and Montgomery (872 permits).

Dallas

In Dallas, there were approximately 1,715 new residential construction permits with a total value of $607.5 million on record last month. As previously noted, the average value of new home construction was highest in Dallas (average value: $354,456) in comparison to other areas reviewed, and the county with the greatest concentration of new residential construction activity was Collin County with 749 new permits for the one-month period.

Austin

Last month, there were just over 600 new residential construction permits with a total value of $200 million added to the HBW database for the Austin area. The average value of new home construction was $332,884, and more than half of all new permits originated from Travis County where there were 330 new permits on record for the one-month period.

San Antonio

In San Antonio, there were 535 new residential construction permits with a total value of nearly $110.5 million last month. The average value of new home construction was lowest in San Antonio (average value: $206,435) in comparison to other Texas metro areas reviewed, and the bulk of new construction activity took place in Bexar County where there were 372 new permits on record for the one-month period.

To gain more information on the builders, homeowners and permits for the construction activity above, check out HBW for your copy of the latest construction data reports. To gain access to the HBW database and receive custom and detailed reports on the latest residential and commercial building activity in Florida, Georgia, Texas, Alabama, and Oklahoma, please contact HBW for details.