Why construction pros should pay more attention to the year‑end data (and maybe even enjoy it)

Who likes construction data reports? I do. And even more so, the upcoming annual construction activity trend reports by HBW are reports that I genuinely look forward to each year. Yes—the big, comprehensive construction data reports. Don’t get me wrong: the monthly and regional breakdowns are incredibly useful, and I share those stats regularly to keep industry professionals informed; not to mention, they help you zero in on what’s happening right now in your specific markets, identify active builders, and track immediate shifts in demand.

But after spending a decade or two (or three) in the construction, design, and architecture industries, I have learned that the annual reports offer something uniquely valuable: perspective. And in this business, perspective is power.

Annual reports allow you to zoom out—way out—and see the broader patterns that only emerge over longer periods of time. When you compare the current year’s activity to the last five, ten, or even thirty‑plus years of HBW’s historical data, you start to see the market with a clarity that short‑term snapshots simply don’t provide. And that’s where the real magic happens.

Why Annual Reports Matter

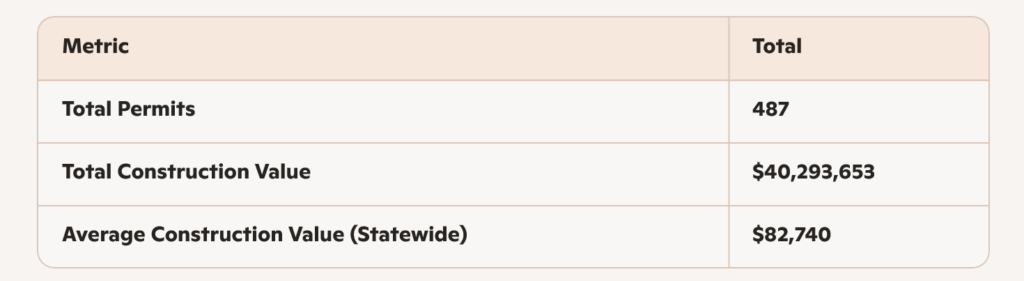

1. Identifying Long‑Term Trends

Monthly data tells you what’s happening. Annual data, for the most part, can tell you why it’s happening.

When you look at a full year in context, you can identify:

- Sustained growth or decline in specific counties or metros

- Shifts in the average value of construction projects

- Emerging builder dominance

- Cyclical patterns tied to economic or demographic changes

- Long‑term increases in specialty categories (hello, swimming pool boom)

2. Improving Market Forecasting

Annual reports act as a built‑in “checks and balances” system for your predictions. Every year, I compare what I expected to happen with what actually transpired. Sometimes I’m spot‑on. Sometimes the market throws a curveball. Either way, the comparison helps me refine my forecasting models and better understand the variables that influence demand—interest rates, migration patterns, supply chain disruptions, weather events, and more. This is especially valuable when advising clients. Being able to say, “Based on the last decade of permit activity, here’s what we can reasonably anticipate for next year,” is a powerful tool.

3. Spotting Market Opportunities

One of my favorite parts (yes, I said favorite) of the annual report is watching how different regions rise to the top—and noticing when a new builder suddenly appears in the top five or top ten. Those shifts aren’t just interesting trivia; they usually point to something meaningful happening in the market. Sometimes it is the emergence of new development corridors or a clear change in what consumers are prioritizing. Other times it reflects a builder expanding into new territory, or it reveals areas where the market is becoming saturated—or, conversely, where new opportunities are opening.

For anyone in the industry, whether they are building homes, remodeling, supplying materials, or offering specialized services, this intelligence is incredibly valuable. It helps industry professionals understand where to direct their time, energy, and resources so that they are aligning their businesses with real and measurable market movement.

4. Seeing the Market’s Highs and Lows Clearly

One of the features I appreciate most in HBW’s construction activity trend reports is the YTD percentage‑change column. It’s a simple addition, but it makes an enormous difference in how quickly I can interpret what’s really happening across different regions and counties. Because the report tracks the increases or decreases in permit activity over the last five years, I can immediately tell whether the current year reflects genuine growth, the continuation of an emerging pattern, a significant downturn, or just the normal ebb and flow we’ve seen historically. The layout itself makes this even easier—the column is clearly boxed off, and the regions and counties are neatly aligned, which allows for fast, intuitive comparisons. With just a glance, I can spot the areas that consistently drive the state’s overall movement, whether they’re pushing the numbers upward or pulling them down. It’s a streamlined way to identify highs, lows, and meaningful shifts without having to dig through layers of raw data.

How to Use HBW’s Annual Reports

If you have never fully dug into the annual reports—or if you’ve only skimmed them—here are a few practical ways to extract real value:

1. Benchmark Your Performance

Compare your permit activity, project values, and market share to regional leaders.

Are you growing faster than the market? Slower? Right on pace?

2. Identify High‑Potential Markets

Look for regions with rising permit volumes, increasing construction values, new builder activity, and/or consistent multi‑year growth. Once you identify these areas, they will serve as your expansion targets.

3. Evaluate Your Service Mix

If pool construction is skyrocketing, outdoor living upgrades may follow. If renovation permits are climbing, homeowners may be choosing to improve rather than move.

Annual data helps you align your offerings with real demand, so make sure to apply it to the overall picture.

4. Strengthen Your Forecasting

When you start looking at multi‑year comparisons, your projections become far more accurate and reliable. Patterns that might be invisible in a single year suddenly come into focus, giving you a stronger foundation for planning everything from staffing levels and inventory needs to marketing budgets and equipment investments. It can even help you make smarter decisions about when (and where) to expand geographically. In other words, the long view gives you the clarity you need to develop your next move.

5. Support Strategic Conversations

Whether you are talking to investors, partners, clients, or internal teams, annual data gives you the credibility and clarity to make informed recommendations. It allows you to ground your ideas in measurable trends rather than gut instinct, which makes every conversation more productive and far easier to navigate. When everyone is working from the same factual foundation, strategic planning becomes less about guesswork and more about aligning around shared, data‑driven priorities.

While I am not promising that you will be as excited about annual permit data as I am, I can say that you might be surprised. There is something energizing about being able to focus your resources in the right regions, with the right services, at the right time. When you can see the big picture, everything else becomes easier:

- Your marketing becomes more targeted.

- Your sales strategy becomes more efficient.

- Your operations become more predictable.

- Your growth becomes more intentional.

And that is the real value of HBW’s annual reports—they help you work smarter, not harder.

Annual building permit reports are more than just year‑end summaries. When applied properly, they are strategic tools that can shape your entire business approach for the year ahead. By understanding last year’s market behavior and identifying long‑term patterns, you will be able to make better decisions, anticipate opportunities, and stay ahead of the competition. So, in future articles I will share building permit data with you (as I have in the past) and walk you through some of the many ways to use HBW reports to your advantage. Who knows? You might even start looking forward to them the way I do. No promises… but it’s possible, especially when you start seeing the results.

For more information on construction business marketing tips, stay connected with the HBW Blog. To get ahead of construction activity and gain access to the latest permitting data in Florida, Texas, Georgia, Alabama and Oklahoma, contact HBW for more information on construction data reports and industry leads.