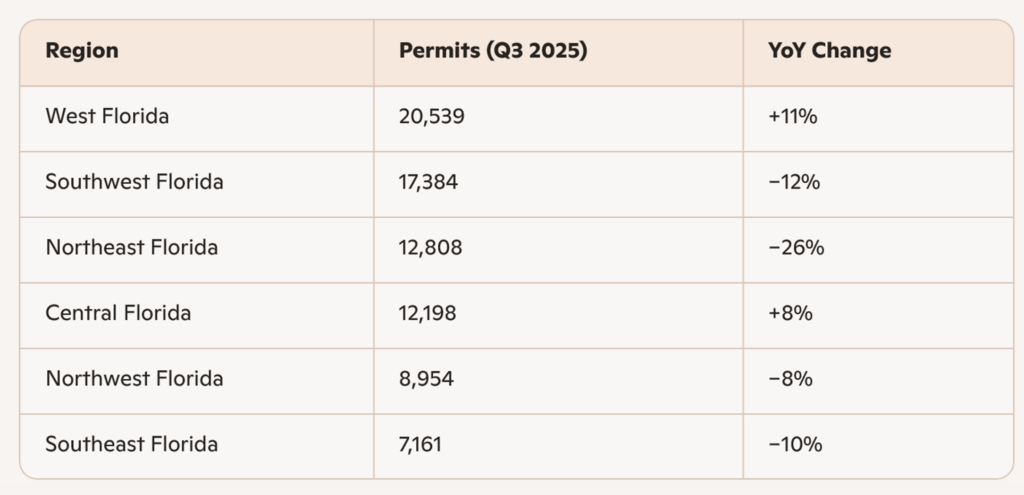

Florida’s residential construction landscape continues to evolve in 2025, with HBW’s latest Building Activity Trend Report offering a comprehensive snapshot of permitting activity across six major regions through the third quarter. While the statewide total of 79,044 new residential construction permits reflects a 6% year-over-year decline, the nuances within regional and county-level data reveal a more complex and instructive narrative.

Statewide Trends:

The 6% statewide decrease in new residential permits through Q3 2025 may initially suggest a softening market. However, when contextualized against prior years—2022’s 5% decline, 2023’s sharper 14% drop, and 2024’s flat performance—the current figure appears less alarming. It may indicate a market in transition rather than contraction. With one quarter remaining, this modest decline could either stabilize or reverse, depending on factors such as interest rates, labor availability, and consumer confidence.

Regional Performance:

West Florida leads the state in total permits, marking a notable 11% increase in comparison to Q3 2024. This uptick is particularly significant given the region’s three-year downward trajectory, reversing prior declines of 4% (2022), 12% (2023), and 12% (2024). The resurgence may signal renewed developer confidence or improved market fundamentals. Southwest Florida and Northeast Florida both experienced double-digit declines, with Northeast Florida’s 26% drop being the most pronounced; such figures may reflect saturation in certain submarkets or shifting demand patterns. Central Florida posted a healthy 8% year-over-year increase, suggesting steady growth and resilience in the face of broader statewide headwinds.

County-Level Highlights

While regional data provides a macro view, county-level analysis uncovers micro-markets that are outperforming or stabilizing.

Counties with Notable Growth:

- Pasco County (West Florida): 5,408 permits, +70% YoY — a standout performer, likely driven by infrastructure expansion and affordability.

- Osceola County (Central Florida): 2,088 permits, +30% YoY — indicative of strong demand in Orlando’s commuter belt.

- Sumter County (West Florida): 3,244 permits, +23% YoY — benefiting from active adult and retirement community development.

- Lake County (Central Florida): ~2,600 permits, +9% YoY — steady growth in suburban corridors.

- Miami-Dade County (Southeast Florida): 1,522 permits, +35% YoY — an uptick in a traditionally high-cost market.

Counties with Declines (but High Volume):

- Polk County (West Florida): 5,586 permits, −21% YoY | Although higher volume, the decline suggests possible cooling demand or permit delays.

- Marion County (Northeast Florida): 4,011 permits, −19% YoY

- Manatee County (Southwest Florida): 3,518 permits, −22% YoY

- Duval County (Northeast Florida): 3,040 permits, −22% YoY | The decline reflects a significant drop in Jacksonville’s core.

- Hillsborough County (West Florida): 3,395 permits, −1% YoY | Hillsborough is proving to be a stable market so far this year, with minimal fluctuation.

- Lee County (Southwest Florida): 7,085 permits, −1% YoY | Lee County is maintaining high volume despite slight contraction.

Third-quarter data can serve as a bellwether for annual performance, especially in Florida’s climate-sensitive construction cycle. With Q3 behind us, the 6% statewide decline may not be definitive. Several counties are exhibiting strong momentum, and West Florida’s rebound could buoy year-end figures. However, declines in key regions like Northeast and Southwest Florida suggest that structural challenges may remain.

Overall, Florida’s residential construction market through Q3 2025 presents a nuanced picture. While the statewide decline may raise eyebrows, the underlying data reveals pockets of robust growth and signs of recovery in previously lagging regions. As the final quarter unfolds, stakeholders should remain agile, leveraging granular insights to make informed decisions in a dynamic environment that presents both promising opportunities and evolving conditions.

To gain more information on the builders, homeowners and permits for the construction activity above, check out HBW for your copy of the latest construction data reports. To gain access to the HBW database and receive custom and detailed reports on the latest residential and commercial building activity in Florida, Georgia, Texas, Alabama, and Oklahoma, please contact HBW for details.