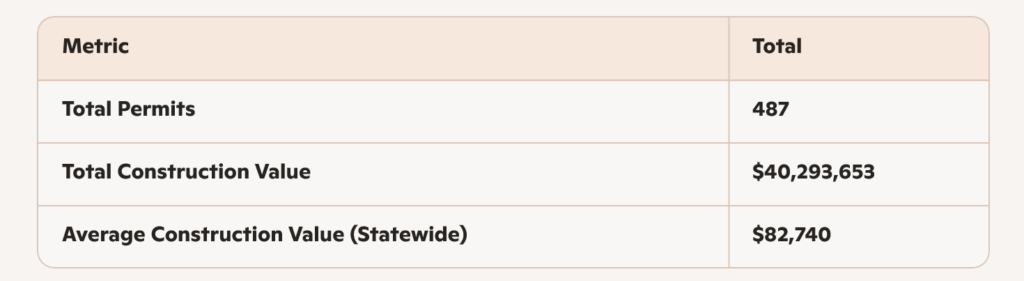

As 2025 drew to a close, Texas continued to demonstrate its position as one of the nation’s most resilient and expansion‑oriented housing markets. Based on the latest HBW construction permit data, the state’s four major metropolitan regions (Houston, Dallas, Austin, and San Antonio) collectively generated 4,509 new residential construction permits in December alone, representing more than $1.5 billion in total construction value statewide.

Today, we will be using HBW’s latest construction data reports to provide an overview and breakdown of permit activity, average construction values, and leading counties within each metro area, offering a clear snapshot of new home construction in the Lone Star State during the month of December:

Houston

When looking at total permit activity, Houston continued to lead the state in December, reinforcing its long‑standing position as Texas’s highest‑volume residential construction market.

- Total Permits: 2,200

- Total Construction Value: $635,042,450

- Average Value per Permit: $288,656

Top‑Performing Counties

- Harris County: 729 permits | Construction Value: $249,272,631

- Montgomery County: 677 permits | Construction Value: $169,388,100

Houston’s strong performance reflects its expansive suburban growth corridors, particularly in Harris and Montgomery counties. The region’s average construction value remains competitive, balancing affordability with the rising cost of materials and labor.

Dallas

Dallas posted the second‑highest permit volume statewide, but notably surpassed Houston in total construction value, signaling a higher concentration of mid‑ to upper‑tier residential projects.

- Total Permits: 1,643

- Total Construction Value: $639,949,155

- Average Value per Permit: $389,500

Top‑Performing Counties

- Tarrant County: 482 permits | Construction Value: $176,383,620

- Collin County: 434 permits | Construction Value: $162,244,505

The Dallas market continues to trend toward higher‑value construction, having the highest average value of construction out of the four regions reviewed for the month. Elevated average permit values suggest a solid appeal for larger single‑family homes and premium‑grade construction specifications.

Austin

In December, the Austin area reflected a more moderate pace of expansion compared to Houston and Dallas, yet the region maintains one of the highest average construction values in the state.

- Total Permits: 387

- Total Construction Value: $146,964,335

- Average Value per Permit: $379,753

Top‑Performing Counties

- Travis County: 198 permits | Construction Value: $76,957,835

- Williamson County: 125 permits | Construction Value: $40,248,500

The Austin area market continues to evolve, with a blend of infill development, high‑value custom homes, and suburban expansion. Both counties of Williamson and Travis remain major drivers of new residential growth, carrying approximately 85 percent of all new construction activity in Austin for the one-month period.

San Antonio

San Antonio recorded the lowest permit volume among the four major metro areas reviewed, but it remains a stable and steadily growing market with strong activity in its primary county.

- Total Permits: 279

- Total Construction Value: $78,413,619

- Average Value per Permit: $281,052

Top‑Performing County

- Bexar County: 175 permits | Construction Value: $46,062,105

The construction landscape in the San Antonio area appears to be characterized by affordability and consistent demand, particularly in Bexar County. While average construction values landed lower than other metro areas reviewed, the region continues to attract builders that may be seeking cost‑efficient development opportunities.

The last month of 2025 closed with Texas demonstrating notable residential construction activity across all major metropolitan regions: Houston led in sheer volume; Dallas dominated in total construction value; Austin maintained one of the highest average values per permit; and San Antonio continued to fit its steady, affordability‑driven profile.

To gain more information on the builders, homeowners and permits for the construction activity above, check out HBW for your copy of the latest construction data reports. To gain access to the HBW database and receive custom and detailed reports on the latest residential and commercial building activity in Florida, Georgia, Texas, Alabama, and Oklahoma, please contact HBW for details.