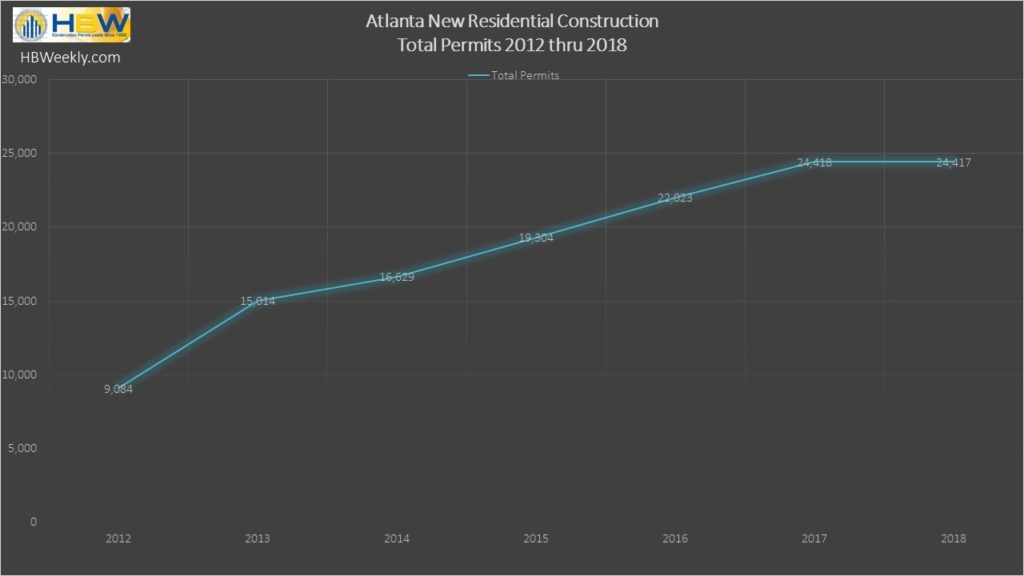

With more than 24,400 residential construction permits in 2018, Atlanta’s high rate of new home construction has held steady for two years in a row.

From 2012 to 2017, Atlanta area housing starts had been sustaining a healthy annual climb, and in 2018 this climb appears to have leveled out, for now. Last year, new home construction in the Metro Atlanta area held steady and in line with 2017, resulting in nearly 24,420 new residential construction permits on file with HBW. While there were no major increases in new residential construction over the year, this is not necessarily a sign of things slowing down. Atlanta continues to be listed as one of the fastest growing U.S. cities, and earlier this year, Forbes ranked it #11 for one of the best places for business and careers. The Atlanta metro has the fifth largest population in the U.S. with 5.9 million residents and is considered to be a top business city and a primary transportation hub of the southeastern U.S. Additionally, Atlanta has seen the job market increase by 2.2% over the last year, and future job growth over the next ten years is predicted to be 38.5%, which is higher than the US average of 38.0%.

Based on HBW’s Building Activity Trend Report for new residential construction in Atlanta, the greatest year-over-year increases and growth in residential construction for 2018 could be found in counties including Dawson (+64%), Walton (+74%) and Carroll (+64%). Walton County’s growth was most notable as it appears to be quickly recovering from the major drop (-36%) in residential construction that it experienced in 2017. On the other hand, housing starts in the counties of Dawson and Carroll have been rapidly climbing since 2012 and continue to be counties to watch.

On the opposite end of the growth spectrum, there were a few counties that did not fare as well this past year. Counties such as Dekalb and Clayton had experienced annual decreases in residential construction ranging from 32% to 55%. For Clayton County, this is the second year in a row that the area is exhibiting signs of a decline in new residential construction. On the other hand, Dekalb County had been experiencing significant annual increases in housing starts since 2013, making last year’s drop unexpected and not indicative of a pattern at this point.

When looking at the areas with the highest concentration of housing starts, Gwinnett County continues to be a standout year after year; despite the 6% year-over-year decrease in new residential construction last year, Gwinnett still ranked #1 for total housing starts having 3,451 new permits on file with HBW. Next in line was Fulton County – With a 4% year-over-year increase in new residential construction, Fulton County ranked second-highest for total new permits (2,558 permits). Coming very close to Fulton and ranking #3 for total housing starts was Forsyth County; with a 4% year-over-year decrease in residential construction, there were 2,393 new permits on file for Forsyth County during 2018.

When reviewing higher value residential construction (homes over $500k), Fulton County continued to be the leading area. Last year, there were more than 350 new homes with values in excess of $500k in Fulton County, making it the leader for higher value residential construction in the Metro Atlanta area.

Information utilized for the graphs and above listed figures for metro Atlanta residential construction was directly derived from HBW construction data reports. To gain access to the HBW database and receive custom and detailed reports on the latest residential and commercial building activity in Florida, Georgia, Texas, Alabama, and Oklahoma, please contact HBW for details.