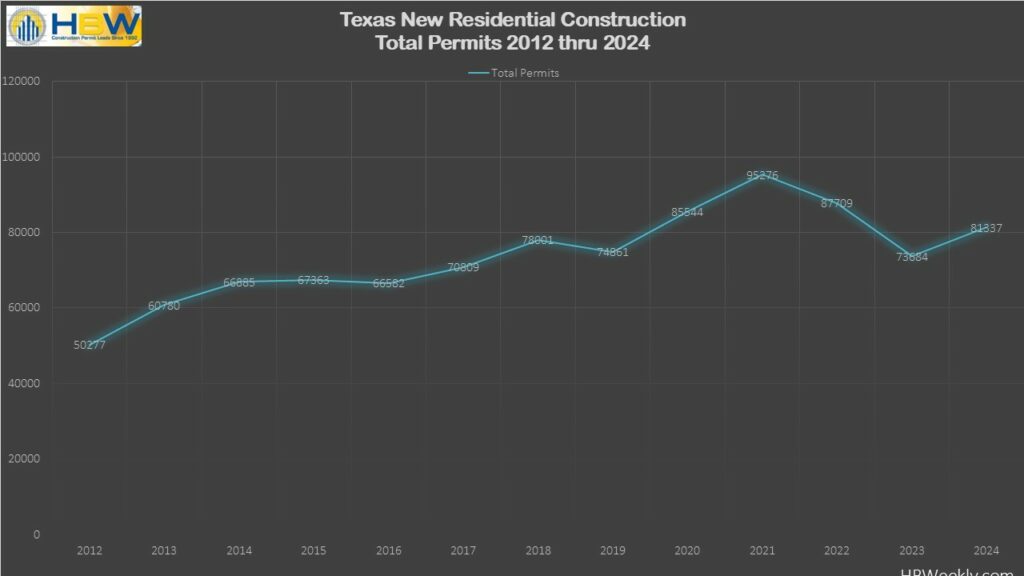

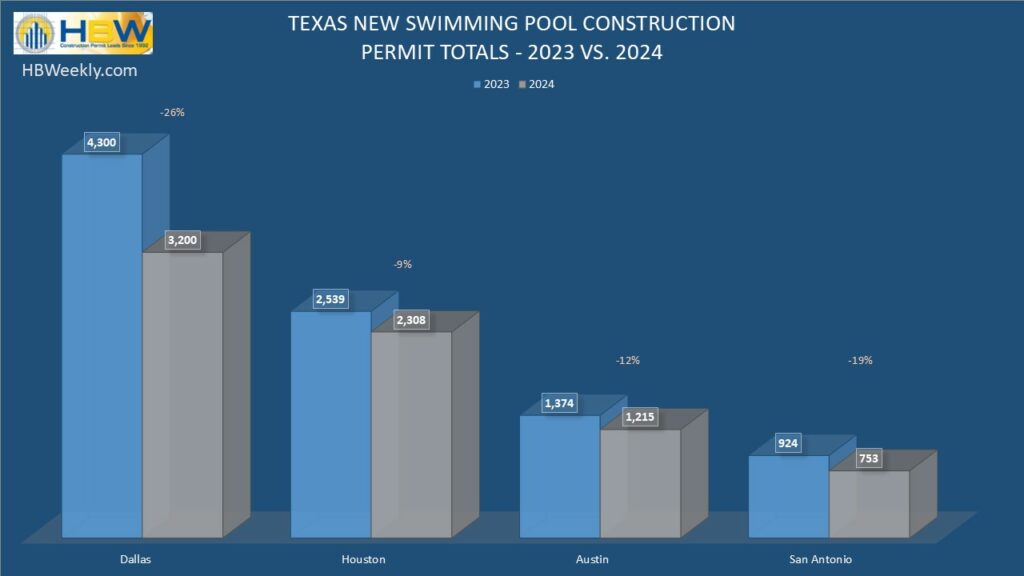

Based on HBW’s latest Swimming Pool Construction Activity Trend Report for Texas, it appears that new swimming pool construction has continued to slow down across the state. In 2024, the Lone Star State demonstrated an 18 percent year-over-year decline in pool construction, resulting in nearly 7,500 new permits on record with HBW from the combined areas of Dallas, Houston, San Antonio and Austin. Every major Metro area exhibited year-over-year decreases in new pool construction activity ranging from -9 percent (Houston) to -26 percent (Dallas).

Here is a closer look at permit data by region…

With a 26 percent year-over-year decrease in permits, the Dallas area had 3,200 new swimming pool construction permits on record last year – ranking it #1 for pool construction. Next in line, the Houston area ranked #2 for new pool construction; with the lowest year-over-year decline (-9%) of any Texas area reviewed, the Houston area had approximately 2,310 new swimming pool construction permits on record with HBW for year.

While the decline in swimming pool construction was not massive in the Austin area last year, there was still a 12 percent (YoY) decrease in permitting activity, resulting in 1,215 new permits on record for the one-year period. Finally, San Antonio and its surrounding areas experienced an annual drop of 19 percent in pool construction, resulting in more than 750 new permits on record with HBW.

When reviewing permit activity from a county-by-county perspective, Harris County (Houston) ranked #1 for total new permits on record last year; with a 7.5 percent year-over-year decrease in new pool construction activity, there were 1,510 new permits added to the HBW database for Harris County. Other counties that carried a higher volume of new swimming pool construction include: Travis County (960 permits) in the Austin area; and Dallas County (965 permits), Collin County (679 permits) and Tarrant County (623 permits) in the Dallas area.

To gain more information on the builders, homeowners and permits for the construction activity above, check out HBW for your copy of the latest construction data reports. To gain access to the HBW database and receive custom and detailed reports on the latest residential and commercial building activity in Florida, Georgia, Texas, Alabama, and Oklahoma, please contact HBW for details.