The actual housing starts fell short of the projected numbers for March 2015, as the nation’s economic recovery hit a soft patch during the first three months of the year. A harsh winter, the West Coast port labor dispute, weak global growth and strengthening of the dollar created speed bumps in the path to America’s financial recovery.

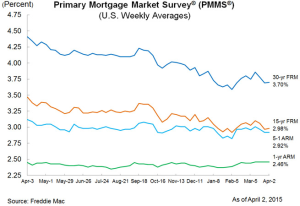

Growth is expected to rebound in the next quarter, but lukewarm data released on Thursday by ITG Investment Research suggests that the momentum will lag too much for the Fed to start raising interest rates before September. Steve Blitz, ITG’s chief economist, says that the economy’s “tepid recovery in March makes it very unlikely the Fed signals a June rate hike at the April meeting. If housing doesn’t recover enough this spring, a September rate hike likely becomes equally improbable.”

The Commerce Department’s seasonally adjusted annual pace of 926,000 new housing units indicates a 2 percent increase over last year. The modest increase failed to offset the majority of Febrary’s decline in home building, which has been blamed on bad weather nationwide. This brief rise in stats for single-family housing did not mitigate the losses accrued in January and February. Multifamily starts fell short of the 1.04 million-unit pace predicted for March.

The new housing starts reflect the underwhelming trends in business activity and manufacturing for April. The Philadelphia Federal Reserve Bank reports that its business activity index rose to 7.5 percent this month from 5.0 percent in March. JP Morgan in New York reports that orders for manufactured goods fell to the lowest level since May 2013. New York state factory activity has been soft in April. The dollar’s 13 percent appreciation combined with softer international demand have slammed the manufacturing sector. “Combined, the April reports are not signaling that manufacturing activity is picking up significantly following the weak first quarter,” said JP Morgan economist Daniel Silver.

A strengthening labor market provides some reason to predict that the housing outlook remains favorable despite the less-than-stellar performance during the first quarter. Although the Labor Department reports a rise in the number of new unemployment activity last week, the job market is tightening as the long-term unemployed find work. The four-week average of claims demonstrates only marginal growth in unemployment, which currently sets below the 300,000-claims-per-week threshold established in December of 2000.

Jesse Hurwitz, an economist for Barclay’s in New York, says that “we continue to view claims data as reflective of overall improvement in labor markets.” As more people receive a paychecks and lending standards ease up slightly, first-time buyers are entering the housing market, which will lead to gains in for 2015. March was the eighth straight month that permits for new residential construction remained above the 1 million-unit mark.