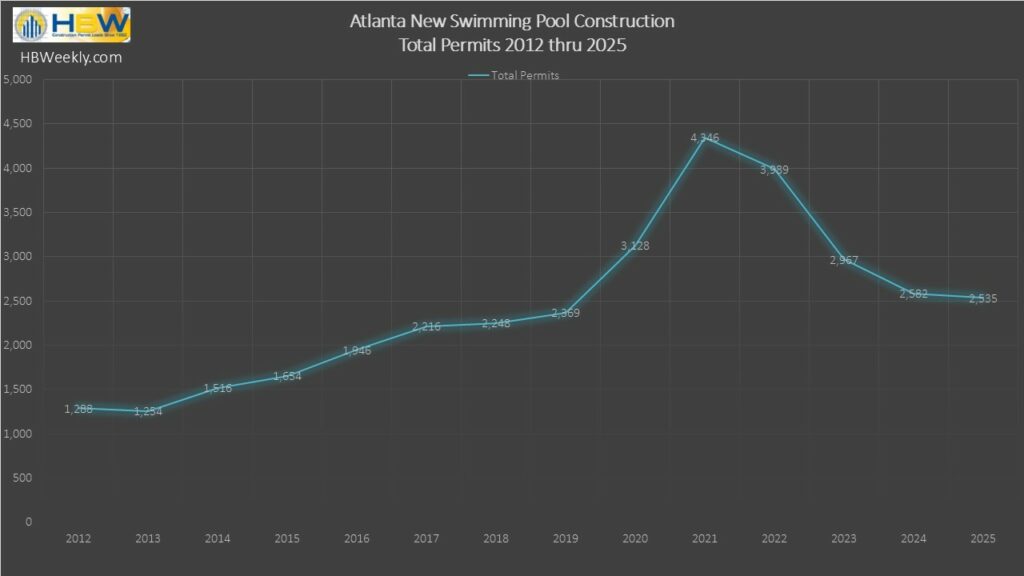

The latest Swimming Pool Construction Activity Trend Report from HBW reveals a Metro Atlanta market that may finally be finding its equilibrium. After several consecutive years of contraction, 2025 closed with 2,535 new swimming pool construction permits, representing a modest 2% year‑over‑year decrease. While technically a decline, this shift is far less severe than the downturns recorded in recent years and suggests that the market may be stabilizing.

To put the trend into perspective, here is a look at the declines over the last few years:

- 2022: ‑8% year‑over‑year

- 2023: ‑26% year‑over‑year

- 2024: ‑13% year‑over‑year

- 2025: ‑2% year‑over‑year

The difference between 2,582 permits in 2024 and 2,535 permits in 2025 is marginal, indicating that demand may be leveling off rather than continuing its previous downward slide.

County‑Level Perspective

Through a closer look at the 24 counties included in HBW’s Metro Atlanta coverage area, a more layered landscape is revealed. Several counties posted meaningful gains, while others continued to cool. The leaders for volume of new permits are as follows:

Fulton County – 494 Permits (+4%)

Fulton led the region in total volume and delivered a 4% increase over 2024. This is a notable shift, as Fulton had mirrored the broader metro decline since 2022. The uptick suggests renewed demand in higher‑value residential corridors and signals potential and early signs of recovery.

Cobb County – 277 Permits (‑11%)

Cobb recorded the second‑highest volume but saw an 11% decline year‑over‑year. This marks a reversal from the 18% increase the county experienced in 2024. The shift may reflect a cooling period following elevated activity, or it may be indicative of tightening consumer budgets in established suburban markets.

Cherokee County – 241 Permits (+11%)

Cherokee continued its upward momentum with an 11% increase, building on a 3% rise in 2024. Two consecutive years of growth point to sustained expansion and a solid consumer draw to outdoor living investments.

Forsyth County – 216 Permits (+14%)

Forsyth posted one of the stronger growth rates in the region at 14% year‑over‑year. This level of performance aligns with ongoing new‑home construction, population growth, and a demographic profile that supports discretionary spending on premium amenities.

Gwinnett County – 182 Permits (‑25%)

Gwinnett continued its multi‑year decline with a 25% drop in 2025. The county has been trending downward since 2022, and the latest figures reinforce ongoing softness in this market segment.

Additional Counties Exhibiting Upward Movement

While smaller in total volume, several counties demonstrated noteworthy improvement:

- Fayette County – 120 Permits (+13%)

A strong double‑digit increase, reflecting steady development and some higher‑end homebuilding activity. - Paulding County – 120 Permits (+6%)

A moderate but meaningful gain, suggesting incremental strengthening. - Jackson County – 103 Permits (+10%)

Though modest in volume, the double‑digit increase highlights rising demand in emerging exurban areas.

The latest data for 2025 offers valuable insights for builders, subcontractors, suppliers, and service providers operating in the swimming pool and outdoor living sectors. A few points to consider include:

1. Stabilization Supports More Reliable Forecasting

After several years of volatility, the near‑flat performance in 2025 provides a more predictable foundation for planning. Firms may be better positioned to anticipate labor needs, material procurement, and seasonal demand cycles.

2. Growth Markets Present Strategic Opportunities

As previously noted, counties such as Fulton, Cherokee, Forsyth, Fayette, Paulding, and Jackson are demonstrating upward momentum, creating pockets of opportunity for industry professionals. Growth markets are likely to support stronger lead‑generation efforts, yield higher returns on targeted marketing initiatives, and sustain growing demand for premium pool packages and comprehensive outdoor‑living enhancements.

3. Softening Markets Require Adjusted Positioning

In counties like Gwinnett and Cobb, firms may find it beneficial to refine their approach by adopting more competitive pricing strategies, expanding and diversifying their service offerings, and strengthening partnerships with homebuilders and remodelers. The cooling markets may also require greater emphasis on customer education, particularly around financing options and the long‑term value of investing in a professionally built swimming pool.

4. Suburban and Exurban Growth Corridors Are Driving Demand

The strongest gains are occurring in counties experiencing new‑home construction and population inflow. Aligning sales efforts with such growth corridors can help firms capture emerging demand early.

5. Permit Data Remains a Critical Competitive Advantage

HBW’s permit‑based intelligence enables construction professionals to:

- Identify active builders and high‑volume neighborhoods

- Track competitor activity

- Forecast market shifts

- Optimize sales territories and resource allocation

While last year did not deliver a full rebound, the Metro Atlanta swimming pool construction market reflected clear signs of stabilization and selective growth. After years of contraction, the modest 2% decline—paired with strong performances in several key counties—suggests that the region may be transitioning into a more balanced and predictable phase.

For industry professionals, the message is clear: opportunity still exists, but it is increasingly localized. Firms that leverage granular market intelligence, adapt to shifting regional dynamics, and position themselves strategically will be best equipped to capitalize on the next phase of growth.

Information utilized for the above listed figures for Metro Atlanta swimming pool construction was directly derived from HBW construction data reports. To gain access to the HBW database and receive custom and detailed reports on the latest residential and commercial building activity in Florida, Georgia, Texas, Alabama, and Oklahoma, please contact HBW for details.