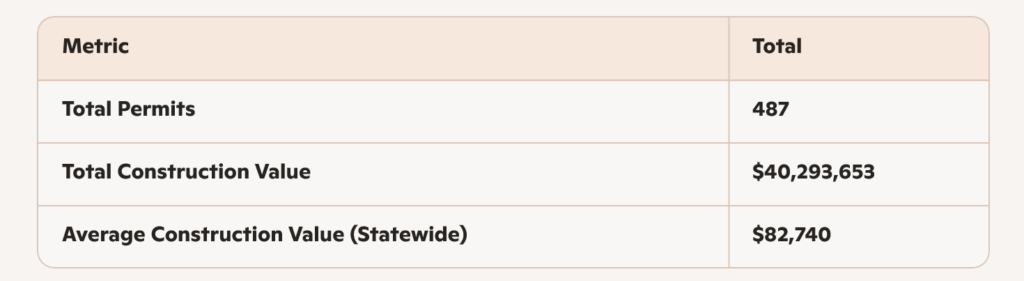

New swimming pool construction across the major metropolitan regions of Texas demonstrated steady activity in November 2025, with a combined 487 new permits on record with HBW. While this reflects only a marginal increase from the 482 permits recorded in October, the month’s data underscores the continued resilience of the residential pool market heading into the winter season. Across Dallas, Houston, Austin, and San Antonio, the total construction value for November reached $40.29 million, driven largely by strong performance in North Texas.

Below is a detailed breakdown of activity by region, including permit volume, construction value, average value, and leading counties.

Statewide Summary

Dallas led the state in both volume and value, while Houston and Austin delivered consistent mid‑range activity. San Antonio, as expected, reflected more modest but steady permit issuance. Here is closer look at the breakdown by region:

Dallas

The Dallas region was the clear frontrunner for November, accounting for nearly half of all new pool construction statewide.

- Total Permits: 224

- Total Construction Value: $19,899,310

- Average Value: $88,836

Leading Counties

- Dallas County: 63 permits, $5,573,631 in construction value

- Tarrant County: 60 permits, $6,574,526 in construction value

Dallas County and Tarrant County together represented more than half of the area’s activity, with Tarrant posting the higher construction value despite issuing slightly fewer permits. The Dallas market continues to demonstrate strong consumer demand for high‑end outdoor living investments, reflected in the region’s above‑average project valuations.

Houston

Houston maintained its position as the second‑largest market for new pool construction in November.

- Total Permits: 129

- Total Construction Value: $10,735,800

- Average Value: $83,223

Leading County

- Harris County: 98 permits, $8,034,800 in construction value

Harris County dominated regional activity, contributing more than three‑quarters of all permits. While Houston’s average project value trailed slightly behind Dallas, it remained aligned with broader statewide norms.

Austin

Austin continued to show strong mid‑market performance, driven primarily by Travis County.

- Total Permits: 101

- Total Construction Value: $7,931,043

- Average Value: $78,525

Leading County

- Travis County: 81 permits, $6,377,043 in construction value

Austin’s totals and average construction value came in below both Dallas and Houston, but the region remains a consistent contributor to statewide totals.

San Antonio

San Antonio reflected the lowest volume and average value among the four major metros, consistent with historical patterns.

- Total Permits: 33

- Total Construction Value: $1,727,500

- Average Value: $52,348

Leading County

- Bexar County: 24 permits, $1,337,500 in construction value

San Antonio’s average project value was the lowest statewide, indicating a market skewed toward more modest residential installations.

Comparative Insights

- Dallas accounted for 46% of all new pool permits statewide and nearly 50% of total construction value.

- Houston and Austin together represented 47% of statewide permits, with Houston slightly ahead in both volume and value.

- San Antonio, while smaller, remains a stable contributor with predictable seasonal patterns.

- Statewide average project value of $82,740 reflects a market that remains healthy despite seasonal slowdowns typical of late Q4.

- The slight increase from 482 permits in October to 487 in November suggests a steady pipeline of residential investment heading into year‑end.

Overall, last month delivered stable figures for new swimming pool construction across Texas, with Dallas anchoring the state’s market strength. Houston and Austin provided balanced mid‑range contributions, while San Antonio maintained modest but consistent activity.

To gain more information on the builders, homeowners and permits for the construction activity above, check out HBW for your copy of the latest construction data reports. To gain access to the HBW database and receive custom and detailed reports on the latest residential and commercial building activity in Florida, Georgia, Texas, Alabama, and Oklahoma, please contact HBW for details.