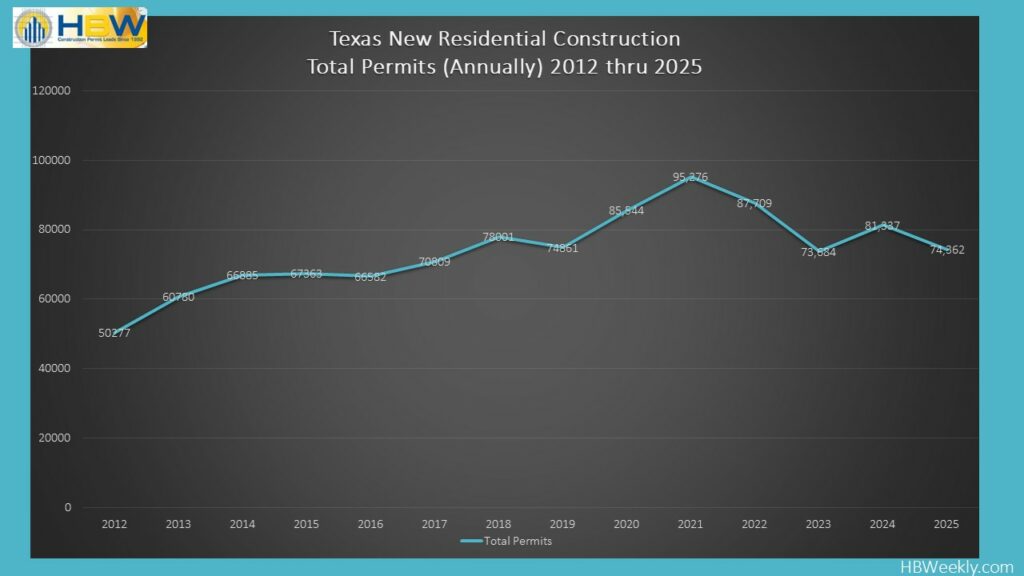

Texas wrapped up 2025 with just over 74,350 new residential construction permits on record, according to the latest HBW Building Activity Trend Report. For a state that leads the nation in homebuilding, last year’s 9% dip in permit volume feels less like a red flag and more like a market taking a breather. What makes 2025 particularly interesting is how it contrasts with the year before. In 2024, Texas actually had a 10% increase in new permits — a rebound after two years of contraction, including an 8% decline in 2022 and a much steeper 16% drop in 2023. So, the pullback in 2025 doesn’t necessarily signal issues. Instead, it fits into the broader ebb and flow that naturally occurs in a high‑growth, high‑demand market like Texas. When a state builds as aggressively as Texas does, occasional recalibration is expected.

Houston

Houston once again carried the largest share of new residential construction, as it reliably does. The metro ended the year with more than 35,520 new permits — a sizable number by any measure, even though it represents a 10% decline from 2024.

Harris County, the region’s core, accounted for nearly 16,000 of those permits and saw a decrease of just over 12%. Montgomery County followed with roughly 10,720 permits, only a modest 4% dip. Even with the slowdown, Houston’s scale remains unmatched, and its suburban counties continue to attract builders looking for land, affordability, and strong long‑term demand.

Dallas

Dallas recorded approximately 25,260 new permits in 2025, a 5% decrease from the year before. But the real story lies in the county‑level shifts beneath the surface.

Collin County (8,634 permits), one of the region’s most active and fastest‑growing areas, saw a notable pullback of about 22%. Yet at the same time, Tarrant County (6,579 permits) delivered one of the most dramatic turnarounds in the entire state. After three consecutive years of decline — including a staggering 47% drop in 2024 — Tarrant surged back with a 65% year-over-year increase in new residential construction permits. A rebound of that size suggests a meaningful shift in builder confidence, buyer demand, or both. When a county swings so sharply after consecutive years of contraction, it often signals that inventory has finally reset, pricing has stabilized, or new development corridors have opened.

Ellis County (2,330 permits) also posted growth, with a 12% year-over-year increase in new permits, making it one of only a handful of counties statewide to reflect annual improvement.

Austin

Austin’s residential construction market cooled only slightly in 2025, ending the year with approximately 7,275 new permits — a small 3% decline. What stands out is the internal balance within the metro.

Travis County (3,390 permits) actually posted a 5% increase in new permits, making it one of the few counties in Texas to exhibit growth this year. Williamson County (2,609 permits), on the other hand, demonstrated a decrease of just over 6%. Austin’s numbers reflect a market that has been recalibrating since its pandemic‑era boom. The region remains fundamentally solid, and the modest shifts in 2025 suggest a market that may be settling into a more sustainable rhythm.

San Antonio

San Antonio experienced the most pronounced slowdown of the four major metros. With just over 6,300 new permits on record, the region saw an 18% year‑over‑year decline. Bexar County (4,048 permits), which accounts for the majority of the area’s residential construction, posted a drop of more than 21%.

While the decline is notable, it doesn’t necessarily indicate weakening demand. San Antonio has been one of the more affordable major metros in Texas, and its construction cycles often move differently from those in Dallas, Houston, or Austin. Last year’s figures may simply reflect a pause after the spike and significant annual growth experienced in 2024.

Despite the overall slowdown statewide and regionally, one segment of the market moved decisively in the opposite direction: homes valued at over $500,000. Across Texas, there were 9,155 new high‑value permits (>$500k) in 2025 — an increase of roughly 9% from the year before. Every major metro contributed to this growth. Dallas led the way with 5,665 high‑value permits, up from just over 5,300 in 2024. Houston followed with a meaningful increase of its own, rising from 1,816 high-value permits in 2024 to 2,086 this past year. Austin (929 high-value permits) added nearly 100 more high‑value projects compared to the previous year. Even San Antonio experienced growth in this segment, climbing from 444 to 475 high-value permits. The given trend suggests that while entry‑level and mid‑market construction may be more sensitive to interest rates and economic uncertainty, the upper end of the market remains resilient. High‑income buyers continue to build, and builders continue to invest in luxury and custom home projects across the state.

The latest reports for the Lone Star State reflect a story of moderation rather than rapid decline. The strong performance in high‑value construction, combined with notable rebounds in select counties like Tarrant and Ellis, suggests that Texas remains fundamentally strong and well‑positioned for future growth. In a state as large and economically diverse as Texas, year‑to‑year fluctuations are not only normal but expected. What matters most is the long‑term trajectory, and based on the 2025 data, that trajectory still points toward resilience, opportunity, and continued demand for new housing across the state.

To gain more information on the builders, homeowners and permits for the construction activity above, check out HBW for your copy of the latest construction data reports. To gain access to the HBW database and receive custom and detailed reports on the latest residential and commercial building activity in Florida, Georgia, Texas, Alabama, and Oklahoma, please contact HBW for details.