Insights from HBW’s Building Activity Trend Report (Totals through Q4 2025)

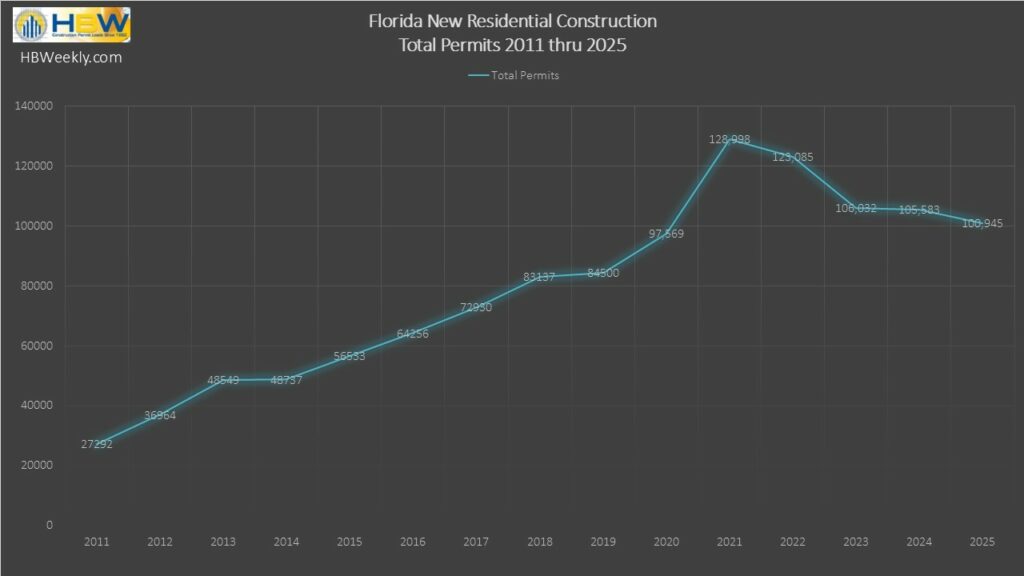

Florida’s residential construction market ended 2025 on a quieter note. According to HBW’s Building Activity Trend Report, new residential permitting across the state declined approximately 4% year over year, totaling 100,945 new permits for the year, compared to 105,583 in 2024.

At first glance, a decline may be concerning, but context matters. When viewed over the past several years, 2025 looks less like a slowdown and more like a market finding its balance as Florida’s construction market has been adjusting for several years:

- 2022: 5% decrease versus 2021

- 2023: 14% decrease versus 2022

- 2024: Flat, signaling stabilization

- 2025: 4% decrease

After the sharp correction in 2023 and a leveling-off in 2024, this year’s modest dip suggests recalibration rather than retreat. This may be indicative of builders proceeding with greater discipline, and projects becoming more targeted by geography, price point, and buyer profile.

For the purpose of this trend report, HBW tracked activity across six major regions in Florida. While most regions showed some degree of decline, the data reveals clear pockets of strength.

- West Florida: 26,427 permits (+20% YoY)

- Southwest Florida: 23,128 permits (–6% YoY)

- Northeast Florida: 15,947 permits (–26% YoY)

- Central Florida: 14,843 permits (+2% YoY)

- Northwest Florida: 11,408 permits (–7% YoY)

- Southeast Florida: 9,192 permits (–10% YoY)

It is easy to see that the headline here is West Florida. Not only did the region lead the state in total volume, but it reversed course after several years of decline.

West Florida: The Standout Story of 2025

West Florida’s 20% year-over-year increase is particularly notable given its recent history:

- 2022: –4%

- 2023: –12%

- 2024: –12%

- 2025: +20%

Even more compelling, six of the seven counties in the region reflected annual gains, and those counties included the following:

- Pasco County: 6,938 permits (+105% YoY)

- Hillsborough County: 4,332 permits (+9% YoY)

- Sumter County: 4,158 permits (+18% YoY)

- Hernando County: 1,726 permits (+73% YoY)

- Citrus County: 1,621 (+31% YoY)

- Pinellas County: 690 permits (+39% YoY)

It is worth noting that while Polk County carried a higher volume of new permits (6,962 permits), it is the only county that reflected a decline (-16% YoY). The takeaway? West Florida appears to have moved from correction to recovery, supported by continued population growth, suburban demand, and improving builder confidence.

Southwest Florida: Still a Volume Leader

With 23,128 new permits, Southwest Florida ranked second statewide in total activity. The counties with the greatest concentration of new construction included:

- Lee County: 8,774 permits (–5% YoY) — the highest-volume county statewide

- Manatee County: 5,762 permits (+5% YoY)

- Sarasota County: 3,654 permits (-14% YoY)

While overall activity across the region dipped slightly (-6% YoY), Southwest Florida remains a core growth engine for residential construction, particularly for master-planned communities and move-up buyers.

Central Florida: Early Signs of a Rebound

Last year, Central Florida recorded 14,843 permits which is somewhat in line with the previous year. While such limited movement may appear less than noteworthy, it is important to recognize that it follows a 6% decline last year and a 14% drop the year before, making this year’s steadiness meaningful.

Counties with higher levels of new construction activity include:

- Brevard County: 3,441 permits (–3% YoY)

- Lake County: 3,206 permits (+3% YoY)

- Orange County: 3,054 permits (-7% YoY)

- Osceola County: 2,431 permits (+15% YoY)

The above listed figures suggest that Central Florida may be stabilizing after several less favorable years.

Northeast Florida: High Volume, Slower Pace

Northeast Florida logged 15,947 permits in 2025 but experienced the state’s largest regional decline (–26% YoY).

Activity was concentrated in a few counties:

- Marion County: 4,823 permits (–23% YoY)

- Duval County: 3,835 permits (–21% YoY)

- St. Johns County: 3,332 permits (–33% YoY)

Rather than a collapse, the data points to a pause as developers recalibrate after a previous year (2024) of strong growth.

Northwest Florida: Varied Across Counties

Northwest Florida posted 11,408 permits, down 7% year over year. It is worth noting that the Northwest region includes 18 counties in total, two of which are bordering counties in Alabama. The bordering counties are included to reflect the broader regional construction market and cross-border development patterns that influence activity in Florida’s Panhandle. Despite the overall decline across the region, there were several counties that showed positive momentum:

- Bay County: 2,162 permits (+8% YoY)

- Santa Rosa County: 1,915 permits (+5% YoY)

- Baldwin County, AL: 1,865 permits (+9% YoY)

Others worked through pullbacks:

- Walton County: 1,163 permits (–17% YoY)

- Escambia County: 1,062 permits (–24% YoY)

Southeast Florida: Selective Strength

Southeast Florida recorded 9,192 new residential construction permits in 2025, reflecting approximately a 10% year-over-year decline. While the region had less permits compared to others, activity remained concentrated in several high-volume counties that continue to shape the market’s direction.

- St. Lucie County: 2,844 permits (–21% YoY)

- Palm Beach County: 2,057 permits (–8% YoY)

- Miami-Dade County: 1,918 permits (+28% YoY)

The divergence among counties is notable. Declines in St. Lucie and Palm Beach point to continued affordability pressures and more measured development pacing, while Miami-Dade’s significant increase underscores ongoing demand for urban, infill, and higher-density residential projects.

Higher-Value Homes: Where Momentum Is Building

With most annual reports, I like to take a moment to review some of the higher value construction figures as they can be telling of where high-end development may be on the rise, or decline. One of the clearest bright spots in 2025 was higher-value residential construction, which is defined as homes valued over $500,000.

- West Florida: 3,532 permits (up from 2,276 in 2024)

- Central Florida: 2,540 permits (up from 2,295)

- Southwest Florida: 2,496 permits (up from 2,095)

While overall permit counts moderated, builders leaned into higher-margin projects, signaling confidence in affluent buyers and long-term demand in certain regions.

The latest residential construction data for Florida during 2025 tells a clear story… The market is not chasing volume at all costs. Instead, it is becoming more selective, more regional, and more value-driven. For contractors, suppliers, and service providers, opportunity remains strong, but ultimately success will depend on understanding where growth is happening, what types of homes are being built, and how buyer preferences are evolving. In short, Florida isn’t building less because demand disappeared. It could simply be that it is building smarter, and for those positioned in the right regions and price points, the year ahead still offers plenty of runway.

To gain more information on the builders, homeowners and permits for the construction activity above, check out HBW for your copy of the latest construction data reports. To gain access to the HBW database and receive custom and detailed reports on the latest residential and commercial building activity in Florida, Georgia, Texas, Alabama, and Oklahoma, please contact HBW for details.