Last week, we examined Texas home construction through the lens of permit activity, highlighting the sheer scale of residential development across the state. In October 2025 alone, 4,341 new residential construction permits were added to the HBW database for Texas, representing a total construction value of $1.49 billion. This week, we turn our attention to the builders themselves—those contractors and companies driving the market forward in the state’s four major metropolitan areas of Dallas, Houston, Austin, and San Antonio.

By analyzing permit volume, construction values, and average project sizes, we gain insight into both statewide leaders and regionally dominant firms. While some builders maintain a strong presence across multiple metros, others demonstrate a more localized strategy, excelling within specific markets. Here is a an overview by metro:

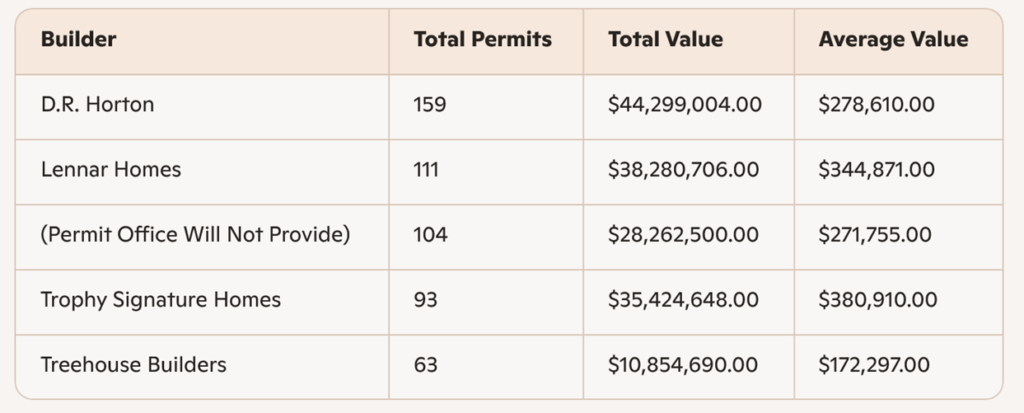

Dallas

Dallas recorded 1,517 new residential permits in October, spread across 165 builders. The top five builders by permit volume were:

The presence of an unnamed builder in the third position raises questions. Permit offices occasionally withhold builder information due to confidentiality agreements, incomplete filings, or administrative restrictions. In some cases, the builder may operate under multiple entities or subsidiaries, complicating attribution. Regardless, the volume of permits suggests a significant market player whose identity remains obscured in public records.

Notably, Trophy Signature Homes reported the highest average value per project ($380,910) out of the top five, indicating a focus on higher-end residential construction compared to Treehouse Builders, whose average value was considerably lower ($172,297) due to the nature of their projects.

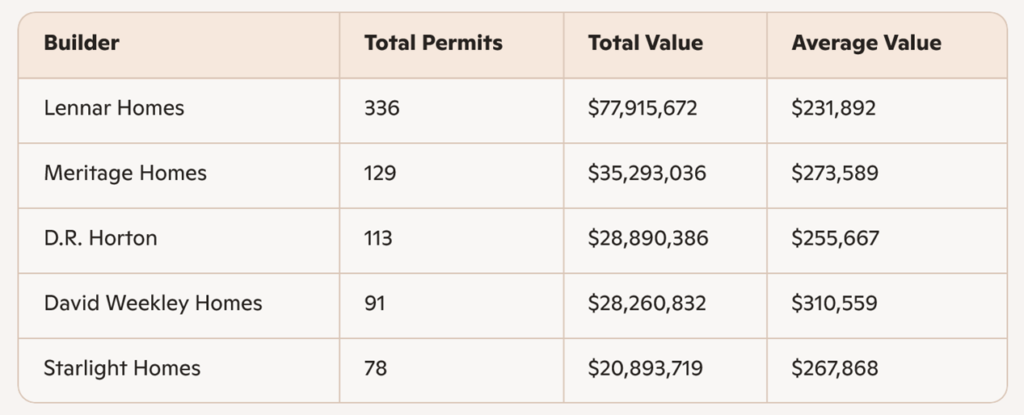

Houston

Houston continues to dominate Texas residential construction, with 2,065 permits issued in October across more than 345 builders. The top five builders for the one-month period were:

Lennar Homes held a commanding lead in Houston, underscoring its expansive footprint, with more than triple the permits of its nearest competitor. David Weekley Homes, while ranking fourth in volume, achieved a notably high average value ($310,559) out of the top five, reflecting its positioning in the mid-to-upper tier of the market.

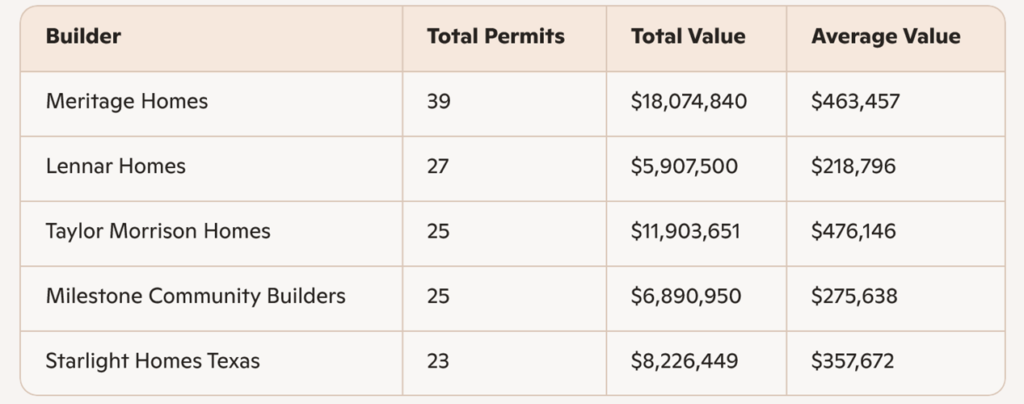

Austin

Austin’s 391 permits were distributed among just over 70 builders, with the following firms leading:

Austin stands out for its elevated average construction values among leading home builders. Both Meritage Homes and Taylor Morrison Homes reported averages exceeding $460,000, signaling a concentration of higher-value projects. This aligns with Austin’s reputation for premium housing markets driven by strong demand from technology professionals and affluent buyers, even though in recent reports it has been describe as becoming more of a buyer’s market after years of growth.

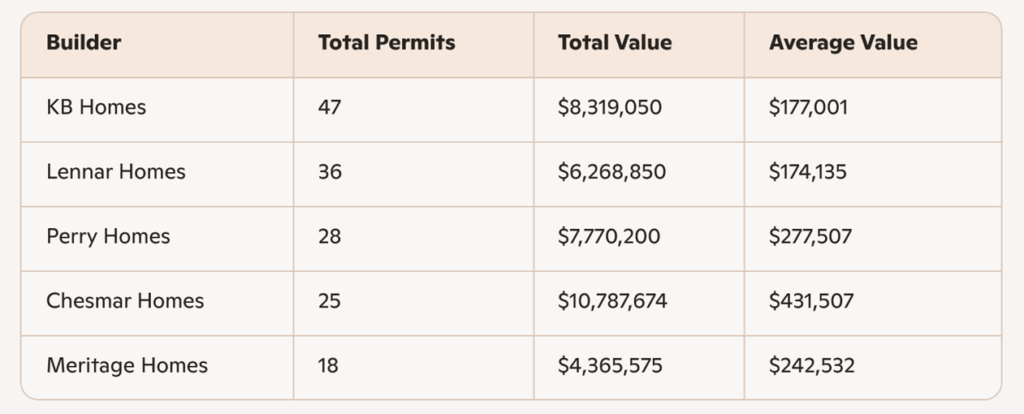

San Antonio

San Antonio recorded 368 permits across nearly 70 builders during the month of October. The top five home builders for the one-month period were as follows:

Out of the top five, Chesmar Homes distinguished itself with the highest average value ($431,507), reflecting a focus on larger or more upscale projects. By contrast, KB Homes and Lennar Homes maintained high permit volumes but at lower average values, suggesting a strategy centered on affordability and entry-level housing.

Statewide Trends and Market Insights

Several builders—most notably Lennar Homes, D.R. Horton, and Meritage Homes—appear consistently across all four metros, underscoring their statewide dominance and diversified market strategies. Their ability to balance volume with varying average project values allows them to capture both entry-level and mid-market segments. Conversely, firms such as Trophy Signature Homes (Dallas), David Weekley Homes (Houston), Taylor Morrison Homes (Austin), and Chesmar Homes (San Antonio) demonstrate strong regional specialization. Their presence in the top five within specific metros highlights potentially targeted strategies that capitalize on local demand dynamics.

While national giants like Lennar Homes and D.R. Horton continue to dominate across multiple regions, regional specialists are carving out significant niches by aligning with local market conditions. The interplay between volume and average project value provides a layered view of builder strategies, offering valuable insight into the evolving dynamics of the Texas market.

To gain more information on the builders, homeowners and permits for the construction activity above, check out HBW for your copy of the latest construction data reports. To gain access to the HBW database and receive custom and detailed reports on the latest residential and commercial building activity in Florida, Georgia, Texas, Alabama, and Oklahoma, please contact HBW for details.