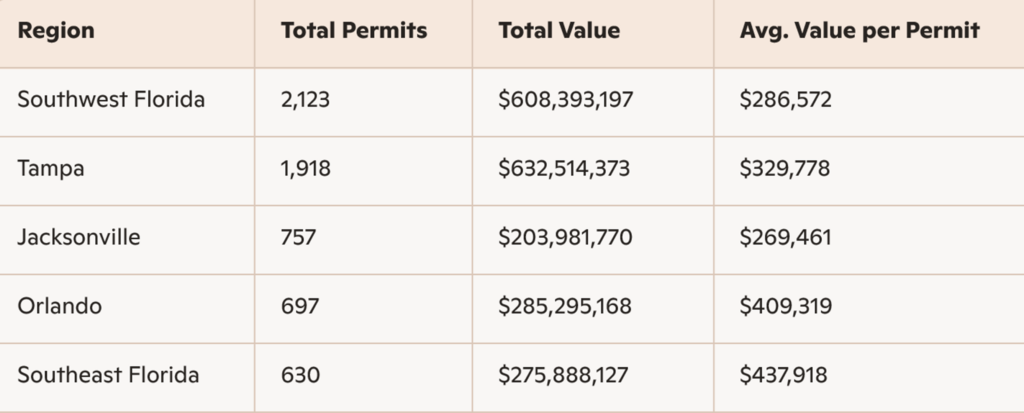

Florida’s residential construction sector demonstrated steady performance in October 2025, with notable differences in permit volume, project valuation, and regional market dynamics across the state’s five principal metropolitan areas. According to HBW’s latest construction data reports, a total of 6,125 new residential construction permits were issued statewide, representing an aggregate construction value of approximately $2.01 billion. Today, we will use HBW’s reports to analyze and review regional performance metrics, highlighting key counties driving activity and offering insight into the evolving residential development landscape.

Southwest Florida:

Southwest Florida emerged as a volume leader and the most active region in terms of permit issuance, recording 2,123 new residential permits with a cumulative construction value of $608.4 million. The average construction value per permit stood at $286,572, reflecting a balanced mix of mid-range and upscale residential developments. When looking at the latest data from a county perspective, two counties stood out in terms of volume:

- Manatee County led the region with 796 permits totaling $209.1 million.

- Lee County followed closely, issuing 640 permits valued at $154.3 million.

Tampa:

The Tampa region reported 1,918 permits with a total construction value of $632.5 million, yielding an impressive average value of $329,778 per unit. This figure suggests a strong presence of higher-end single-family homes and custom builds. Out of the counties that make up the area, more than half of all new permits originated from the following:

- Pasco County issued 520 permits valued at $197.3 million.

- Polk County was nearly on par, with 562 permits totaling $196.2 million, perhaps driven by its affordability and strategic location between Tampa and Orlando.

Jacksonville:

Jacksonville’s residential construction market posted 757 permits with a total value of $204 million, translating to an average project value of $269,461. While the volume was lower relative to most other Florida regions reviewed, the area continues to benefit from steady population inflows and infrastructure investment. From a county perspective, the bulk of all new permits originated from the following:

- Duval County accounted for 274 permits and $48.7 million in value, reflecting urban infill and redevelopment trends.

- St. Johns County, known for its high-quality school districts and planned communities, issued 216 permits valued at $60.6 million.

Orlando:

Orlando recorded 697 permits with a total construction value of $285.3 million, resulting in a notably high average value of $409,319. This suggests a concentration of luxury and semi-custom homebuilding activity, particularly in suburban and exurban zones. Out of the six counties that make up the area, the following carried well more than half of all new home construction activity:

- Orange County issued 183 permits totaling $75.8 million.

- Brevard County led the region in volume with 244 permits and a valuation of $106.9 million, driven by coastal demand.

Southeast Florida:

Southeast Florida, while posting the lowest permit volume at 630, registered the highest average construction value at $437,918, with a total valuation of approximately $275.9 million. This underscores the region’s premium market positioning and scarcity of available land for development. Out of the six counties that make up the area, the following carried the bulk of new residential construction for the month:

- St. Lucie County led in volume with 245 permits valued at $73.6 million.

- Palm Beach County, with 167 permits totaling $89 million, continues to attract high-net-worth buyers and luxury developers.

Statewide Summary

The data for October 2025 reveals a divided market. Regions like Tampa and Southwest Florida are leading in volume, while Southeast and Orlando command higher per-unit valuations. This divergence reflects broader demographic and economic trends, including migration patterns, land availability, and consumer preferences. As Florida continues to experience population growth and housing demand, regional construction trends will remain a critical barometer for developers, investors, and policymakers working within the Sunshine State.

To gain more information on the builders, homeowners and permits for the construction activity above, check out HBW for your copy of the latest construction data reports. To gain access to the HBW database and receive custom and detailed reports on the latest residential and commercial building activity in Florida, Georgia, Texas, Alabama, and Oklahoma, please contact HBW for details.