Residential Construction in Florida: Slowing Decline Suggests Market Stability in 2024

After experiencing two consecutive years of decline, Florida’s residential construction market is showing signs of stabilization. Since 2022, the state has faced annual decreases in new residential construction. However, in 2024, the market exhibited a marginal decline of approximately 1 percent, culminating in nearly 105,600 new permits recorded by HBW. This minimal change suggests a potential improvement in market conditions.

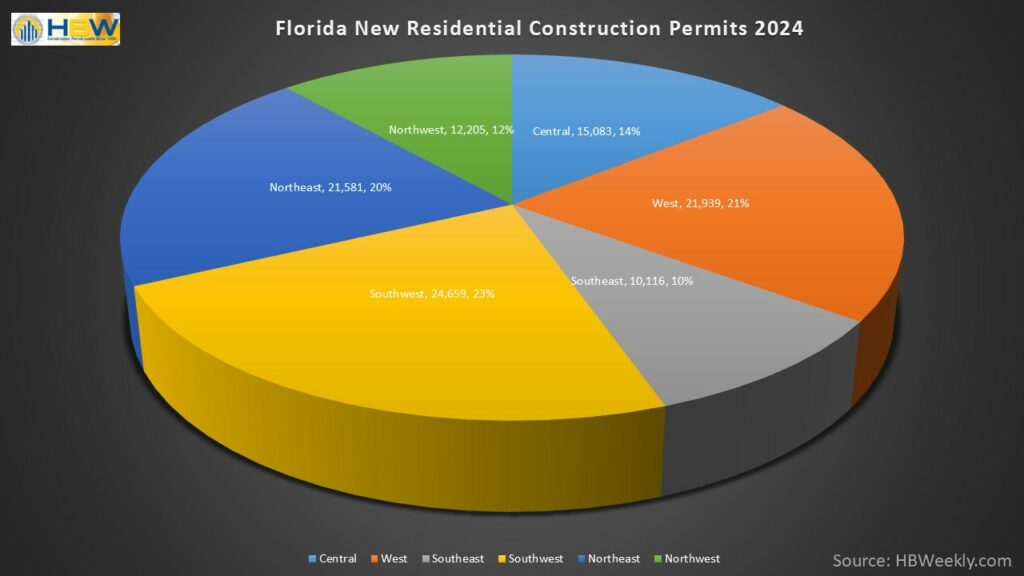

From the six major Florida regions reviewed (Southeast, Southwest, West, Central, Northeast, Northwest), year-over-year changes in total permits ranged from a low of -12 percent (West) to a high of +11 percent (Northeast). Notably, the southwestern region of Florida led in new home construction, with 24,659 new permits, reflecting a 3 percent year-over-year increase. Out of the five counties reviewed in the region, Lee (9,188 permits) and Manatee (5,509) accounted for the majority of permits. Prominent builders such as Lennar Homes, Pulte Homes, and D.R. Horton were significant contributors in this region.

In addition to the Southwest, other regions that exhibited greater amounts of new home construction last year include West (21,939 permits) and Northeast (21,581 permits) Florida, with the northeastern region exhibiting the most significant year-over-year growth (+11 percent) of all regions reviewed.

When reviewing HBW’s Building Activity Trend Reports to identify regions carrying the greatest amount of higher value (>$500k) residential construction projects, Central and West Florida were standouts, having 2,295 and 2,276 new higher value permits added to the HBW database last year.

Here is a closer look at permit totals for new home construction in Florida last year:

Total Permits by Region

From a broader perspective, the South, including Florida, led the nation in building permit approvals in 2024, primarily for single-unit housing. This trend underscores the sustained demand for residential construction in the area. (source: CoreLogic)

While Florida’s residential construction market experienced a slight decline in 2024, the stabilization in permit numbers and the strong performance of key builders suggest a cautiously optimistic outlook for industry professionals as they navigate the evolving landscape.

To gain more information on the builders, homeowners and permits for the construction activity above, check out HBW for your copy of the latest construction data reports. To gain access to the HBW database and receive custom and detailed reports on the latest residential and commercial building activity in Florida, Georgia, Texas, Alabama, and Oklahoma, please contact HBW for details.