According to HBW’s latest Construction Activity Trend Report for Florida swimming pool construction, the market may be turning a corner after three consecutive years of decline. Through the third quarter of 2025, a total of 22,235 new swimming pool construction permits have been added to the HBW database, reflecting a 4% year-over-year increase compared to Q3 2024. While modest, this uptick signals a potential rebound and renewed consumer confidence in residential investment.

To contextualize the current growth:

- 2022 saw a -6% year-to-date decline in permits.

- 2023 experienced a sharper -22% contraction.

- 2024 continued the downward trend with a -10% year-over-year drop.

Against this backdrop, the 4% increase in 2025—though not dramatic—suggests the market may be stabilizing and entering a recovery phase. For builders, suppliers, and subcontractors, this could indicate a shift in demand dynamics and an opportunity to recalibrate operations and marketing strategies.

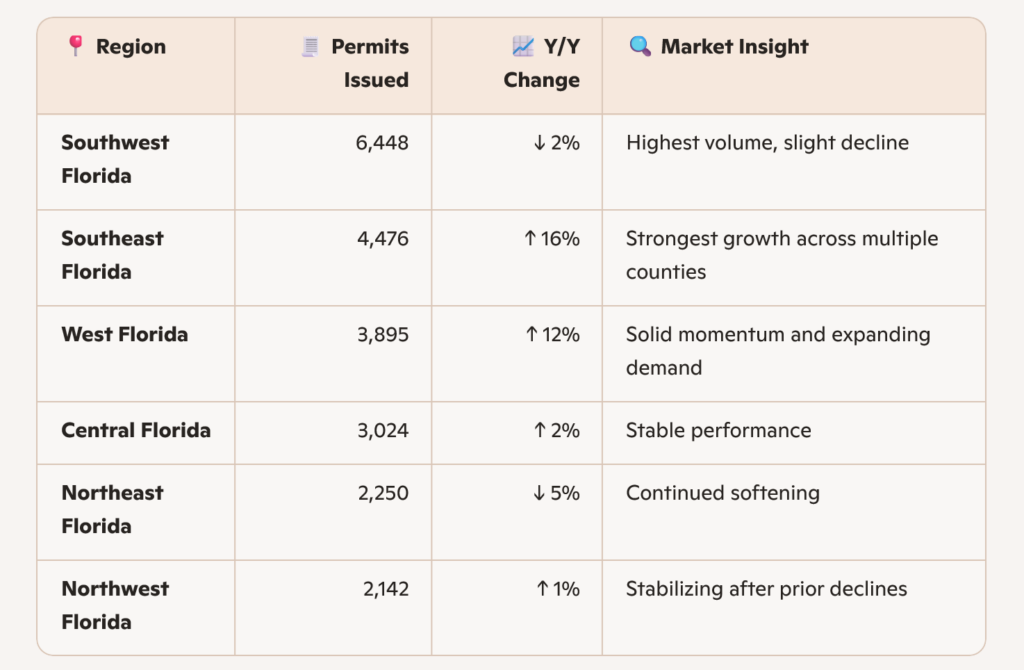

HBW’s report breaks down permit activity across six major regions, revealing varied performance:

Southwest Florida continues to lead the state in total swimming pool construction volume through the third quarter of 2025, although it experienced a slight year-over-year decline. In contrast, Southeast Florida has emerged as the strongest growth region, posting a 16% increase in permits, fueled by heightened activity in key counties including Miami-Dade and St. Lucie. West Florida also demonstrated solid momentum with a 12% year-over-year rise, bolstered by significant surges in Pasco and Sumter counties.

County-Level Highlights:

Several counties demonstrated significant permit activity and growth momentum; the breakdown is as follows:

Top Counties by Permit Volume

- Lee County (SW): 1,943 permits +7% Y/Y

- Palm Beach County (SE): 1,521 permits -2% Y/Y

- Sarasota County (SW): 1,323 permits 0% Y/Y

- Miami-Dade County (SE): 1,237 permits +29% Y/Y

- Collier County (SW): 1,124 permits -13% Y/Y

- Manatee County (SW): 1,096 permits -9% Y/Y

- Hillsborough County (W): 1,084 permits -9% Y/Y

Counties with High Growth Rates

- Pasco County (W): 872 permits +107% Y/Y

- St. Lucie County (SE): 585 permits +31% Y/Y

- Sumter County (W): 637 permits +16% Y/Y

- Bay County (NW): 392 permits +13% Y/Y

The regions with higher gains and levels of growth may reflect emerging residential development corridors, increased consumer demand for outdoor amenities, or favorable permitting environments. For contractors and developers, monitoring and eventually targeting counties with consistent growth patterns could yield higher ROI and strategic expansion opportunities.

Overall, the latest data suggests several actionable insights:

- Diversify regional operations: Firms heavily concentrated in declining counties may consider expanding into high-growth areas.

- Monitor permitting trends: Year-over-year permit activity is a leading indicator of future construction volume and resource allocation needs. Keep an eye out for upcoming annual reports, as well as utilize archived reports to identify established patterns versus standard or seasonal fluctuations.

- Leverage market momentum: With signs of recovery, it may be a good time to look into possible investments in marketing, workforce development, and/or supply chain optimization.

While Florida’s swimming pool construction market is not yet booming, the 4% year-over-year increase in permits through Q3 2025 marks a meaningful shift from the contraction of previous years. Regional and county-level data reveal pockets of strong growth that industry professionals may use to their advantage. As the market continues to evolve, staying informed and agile will be key to navigating and being successful in the next phases of Florida’s construction landscape.

To gain more information on the builders, homeowners and permits for the construction activity above, check out HBW for your copy of the latest construction data reports. To gain access to the HBW database and receive custom and detailed reports on the latest residential and commercial building activity in Florida, Georgia, Texas, Alabama, and Oklahoma, please contact HBW for details.